OUTSOURCED TAX RETURN PREPARATION

BY CERTIFIED PUBLIC ACCOUNTANT

Based In Miami Dade

Outsourced Tax Return Preparation will eliminate all your staffing concerns, and will guarantee your profit line. If you are like many other small tax preparation offices, then you have experienced staffing issues that have severely impacted your bottom line. I can prepare your tax returns while you focus on servicing your client and on activities that drive your business. Implement outsourced tax services and your bottom line will thank you.

Having designed, managed and supervised paperless workflows for boutique and Big 4 firms. I can bring your firm to the 21st century just in time for you to make it to the 22nd.

Outsourced Tax Return Preparation with peace of Mind:

- Personally Prepared by CPA. Physically in Your Office for Briefing / De-Briefing

- 100% Paperless Workflow - Turnkey

- CPA Designed Intake Questionnaires. Dynamic, User Friendly

- Client Portal

- e-Signatures

- Thousands of Tax Returns Prepared. Big 4 Experience.

START IMPROVING YOUR BOTTOM LINE AND REDUCE YOUR STAFFING BURDENS TODAY

Unlike other outsourced tax return preparation services, I will personally serve you. I will be in your office for briefing and de-briefing – and to bridge the gap to get your firm 100% paperless. But I am not the lady in the picture, she just helps me with the sales.. Click on the button to schedule a zoom call and get to know me in person.

I am a Certified Public Accountant with over 12 years experience preparing tax returns in high volume settings. I provide flat fee outsourced tax preparation.

OUTSOURCED TAX RETURN PREPARATION

BY CERTIFIED PUBLIC ACCOUNTANT

In Miami Dade

Outsourced Tax Return Preparation will eliminate all your staffing concerns, and will guarantee your profit line. If you are like many other small tax preparation offices, then you have experienced staffing issues that have severely impacted your bottom line. I can prepare your tax returns while you focus on servicing your client and on activities that drive your business. Implement outsourced tax services and your bottom line will thank you.

I have designed, managed and supervised paperless workflows for boutique and Big 4 firms. I can bring your firm to the 21st century just in time for you to make it to the 22nd.

Outsourced Tax Return Preparation with peace of Mind:

- Personally Prepared by CPA. Physically in Your Office for Briefing / De-Briefing

- 100% Paperless Workflow - Turnkey

- CPA Designed Intake Questionnaires. Dynamic, User Friendly

- Client Portal

- e-Signatures

- Thousands of Tax Returns Prepared. Big 4 Experience.

START IMPROVING YOUR BOTTOM LINE AND REDUCE YOUR STAFFING BURDENS TODAY

Unlike other outsourced tax return preparation services, I will personally serve you. I will be in your office for briefing and de-briefing – and to bridge the gap to get your firm 100% paperless. But I am not the lady in the picture, she just helps me with the sales.. Click on the button to schedule a zoom call and get to know me in person.

I am a Certified Public Accountant with over 12 years experience preparing tax returns in high volume settings. I provide flat fee outsourced tax preparation.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer semper nisl quis quam pellentesque, vel tincidunt felis laoreet. Vivamus quis elementum dui. Vivamus elementum tincidunt lectus, vel scelerisque turpis ultricies sed. Aenean ultrices tortor sit amet molestie elementum. Nulla tincidunt, libero eget bibendum iaculis, lorem mauris tristique mi, dapibus vulputate felis risus a turpis. Etiam eu libero vulputate velit tempus tempus. Maecenas ac laoreet dolor. Nam non tempor lacus. Vestibulum tempor tortor a elit varius, eu tincidunt massa vulputate. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Aenean ac sapien sit amet urna tincidunt pellentesque. Aliquam quis quam quis urna tincidunt pretium at cursus diam.

BENEFITS

Lowest Cost

I am Certain I can beat your In-House processing costs. We are happy to work on a fixed percentage of the fee.

Gramm-Leach-Bliley Act (GLBA) Compliant

The requirements established by GLBA enhance data security requirements imposed by the Federal Deposit Insurance Corporation (FDIC). The function of the GLB Act is to guarantee that financial institutions and their affiliates secure the confidentiality of personally identifiable information collected from customer records in paper, electronic or other kinds. The law requires afflicted business to adhere to strict guidelines that govern data security.

100% Satisfaction

Guaranteed

I personally stand by all tax returns I prepare. In the event of an Audit, I will be your first line of defense.

customer journey

Firm Obtains Engagement Letter and Payment, by using the online portal and entering Only Four Parameters:

- Client Name

- Client Email

- Fee Estimate

- Organizers Needed

Portal Sends Electronic Engagement Letter , Sec 7216 Consent, and Online Payment

Taxpayer electronically Signs Engagement Letter, Pays Fees in advance to Firm, Answers Online Dynamic Questionnaire (Customized) , and uploads files.

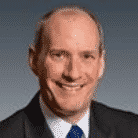

Ed Reviews documents

- Ed marks Missing Information in Online Portal

- Online Portal Sends Automatic reminders for missing information

- Firm Follows up on unresponsive clients.

Ed Uploads Completed return to portal

Portal Notifies Taxpayer

Ed Answers client Questions as necessary - through the online portal.

Taxpayer e-Signs Tax Return in Portal Electronically (Where Form Permits)

ED Files Tax Return

Firm Saves Supporting Documentation and copy of tax return, debriefs the client taxpayer and Marks Client Completed.

COMMENTS

I first worked with Ed when I needed a professional to help me with a number of issues which needed immediate attention. He and his team exceeded all my expectations and I will continue to use their services in the future.

S.R. Expat Formerly served By Big 4 Firm

Expat

Ed worked for me as a project accountant on several complex projects at Goodwill. He did a great job for us and was extremely professional in all his work. Key attributes of Ed’s work included excellent follow-up, frequent status reports and clear documentation. He completed the work on a timely basis and ensured that we were satisfied with his work. I would not hesitate to hire him back.

Patrick Duff

CFO - Morgan Memorial Goodwill Industries

Ed’s analytical skills and attention to detail enable him to make quick and accurate decisions in a fast paced work environment. Ed operates with integrity and continuosly looks for ways to improve. It was always a pleasure to work with head, we benefited from his financial knowledge and he is truly missed. Ed will be an asset to anyone seeking his professional assistance.